The 15-Second Trick For Mileagewise - Reconstructing Mileage Logs

The 15-Second Trick For Mileagewise - Reconstructing Mileage Logs

Blog Article

The Best Guide To Mileagewise - Reconstructing Mileage Logs

Table of Contents10 Easy Facts About Mileagewise - Reconstructing Mileage Logs ShownLittle Known Facts About Mileagewise - Reconstructing Mileage Logs.The 30-Second Trick For Mileagewise - Reconstructing Mileage LogsNot known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs All About Mileagewise - Reconstructing Mileage LogsExcitement About Mileagewise - Reconstructing Mileage LogsThe Basic Principles Of Mileagewise - Reconstructing Mileage Logs

Timeero's Fastest Distance attribute recommends the shortest driving path to your employees' destination. This feature boosts productivity and contributes to cost savings, making it a vital property for services with a mobile labor force.Such a strategy to reporting and conformity streamlines the commonly intricate job of managing mileage costs. There are lots of advantages associated with making use of Timeero to maintain track of gas mileage.

5 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

These added confirmation actions will certainly keep the Internal revenue service from having a reason to object your gas mileage records. With exact mileage tracking innovation, your employees do not have to make rough mileage price quotes or also stress regarding mileage expenditure monitoring.

For instance, if an employee drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all automobile expenditures. You will require to continue tracking mileage for job also if you're making use of the real cost technique. Maintaining mileage documents is the only way to separate organization and personal miles and supply the proof to the internal revenue service

Most mileage trackers let you log your journeys by hand while calculating the range and repayment quantities for you. Several also included real-time trip monitoring - you require to begin the application at the start of your trip and stop it when you reach your final destination. These applications log your begin and end addresses, and time stamps, together with the total distance and compensation amount.

Things about Mileagewise - Reconstructing Mileage Logs

One of the concerns that The IRS states hop over to these guys that car expenses can be considered as an "average and essential" cost in the training course of operating. This consists of costs such as gas, maintenance, insurance coverage, and the lorry's depreciation. Nonetheless, for these costs to be considered insurance deductible, the automobile needs to be used for organization objectives.

The Basic Principles Of Mileagewise - Reconstructing Mileage Logs

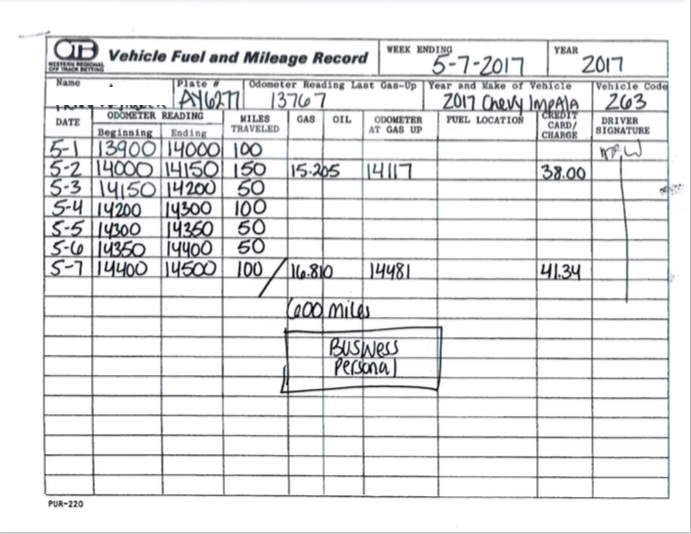

In in between, carefully track all your business trips noting down the starting and ending readings. For each journey, document the place and company objective.

This consists of the total organization mileage and overall mileage buildup for the year (organization + personal), trip's date, destination, and function. It's necessary to videotape tasks immediately and maintain a contemporaneous driving log describing date, miles driven, and organization function. Here's how you can improve record-keeping for audit objectives: Beginning with guaranteeing a thorough mileage log for all business-related traveling.

4 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

The actual costs approach is an alternative to the conventional gas mileage price method. As opposed to determining your deduction based upon a fixed price per mile, the actual expenses technique permits you to deduct the actual expenses linked with using your vehicle for service objectives - free mileage tracker app. These prices consist of gas, upkeep, repair work, insurance, depreciation, and various other related expenditures

Those with substantial vehicle-related expenditures or distinct problems may benefit from the real costs technique. Eventually, your chosen technique should straighten with your particular economic goals and tax scenario.

The 3-Minute Rule for Mileagewise - Reconstructing Mileage Logs

(https://padlet.com/tessfagan90/my-sweet-padlet-o4pk9ieoiku5vd1j)Calculate your total organization miles by using your beginning and end odometer readings, and your tape-recorded organization miles. Accurately tracking your specific mileage for organization journeys help in corroborating your tax reduction, particularly if you choose for the Requirement Mileage method.

Keeping an eye on your mileage by hand can require diligence, however bear in mind, it might save you cash on your taxes. Adhere to these actions: List the date of each drive. Record the total gas mileage driven. Consider noting your odometer analyses before and after each trip. Write down the starting and ending points for your journey.

Some Ideas on Mileagewise - Reconstructing Mileage Logs You Should Know

In the 1980s, the airline sector came to be the very first commercial individuals of general practitioner. By the 2000s, the delivery market had adopted GPS to track packages. And currently nearly everybody uses GPS to navigate. That suggests nearly every person can be tracked as they tackle their service. And there's snag.

Report this page